Table of Contents

Introduction

The late 1990s witnessed an unprecedented surge in the stock market, particularly in the technology sector. This period, known as the “Tech Bubble” or “Dot-Com Bubble,” was marked by a frenzied enthusiasm for internet-based companies, leading to substantial investment and, eventually, a significant market crash.

The Dot-Com Boom

In the mid-1990s, the internet revolutionized communication and business processes. As a result, numerous startups emerged, focusing on online ventures and e-commerce. Investors were captivated by the potential of these companies, pouring money into any business with a “.com” attached to its name.

Irrational Exuberance

Alan Greenspan, the then-chairman of the Federal Reserve, coined the term “irrational exuberance” in 1996 to describe the overvaluation of stocks during this period. Investors seemed willing to overlook traditional valuation metrics, driven by the belief that the internet would revolutionize commerce and render traditional business models obsolete.

The Climax and Burst

Peak Valuations

By the late 1990s, stock valuations for many tech companies had reached astronomical levels. Companies with little or no profits were being valued in the billions, solely based on the promise of future growth.

Market Correction

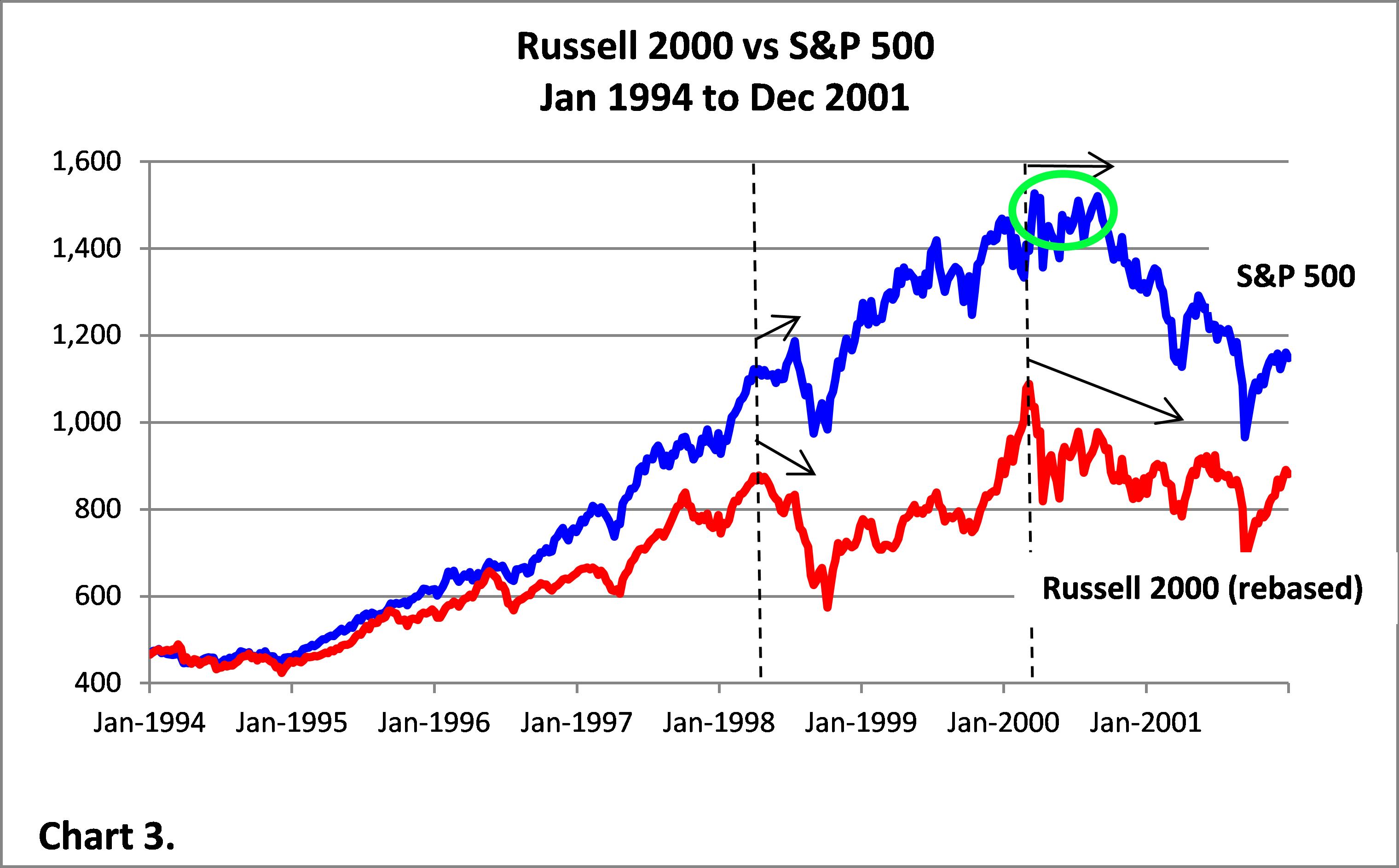

In 2000, the bubble burst. The stock market witnessed a sharp decline, particularly in the technology sector. Many dot-com companies, unable to sustain their inflated valuations, faced financial troubles and bankruptcy.

Lessons Learned

Dot-Com Legacy

While the Dot-Com https://teens4technology.org/ led to significant losses for investors, it also laid the groundwork for the modern internet landscape. Surviving companies learned valuable lessons about sustainable business models, profitability, and the importance of sound financial practices.

Impact on Regulation

The Tech Bubble prompted regulatory changes to prevent similar occurrences. Stricter accounting standards and increased scrutiny of initial public offerings (IPOs) were implemented to protect investors.

The Tech Industry Today

Resilience and Growth

Despite the Dot-Com Bubble’s burst, the tech industry emerged stronger. Companies that weathered the storm adapted, implementing more sustainable practices. The 2000s and 2010s saw the rise of tech giants like Google, Amazon, and Facebook.

Continuous Innovation

The aftermath of the Tech Bubble highlighted the importance of continuous innovation. Tech companies focused on creating value through groundbreaking technologies rather than speculative stock market hype.

Conclusion

The Tech Bubble of the late 1990s remains a pivotal moment in financial history. It serves as a cautionary tale about the dangers of speculative investing and the importance of sustainable business practices. While the bubble led to significant losses, it also paved the way for a more mature and resilient tech industry that continues to shape the world today.